Homeowners Insurance in and around Crescent City

Looking for homeowners insurance in Crescent City?

Help cover your home

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

With your home protected by State Farm, you never have to be anxious. We can help you make sure that in the event of damage from the unpredictable fire or burglary, you have the coverage you need.

Looking for homeowners insurance in Crescent City?

Help cover your home

Homeowners Insurance You Can Trust

Navigating the unexpected is made easy with State Farm. Here you can construct a personalized policy or submit a claim with the help of agent Lisa McKeown. Lisa McKeown will make sure you get the considerate, dependable care that you and your home needs.

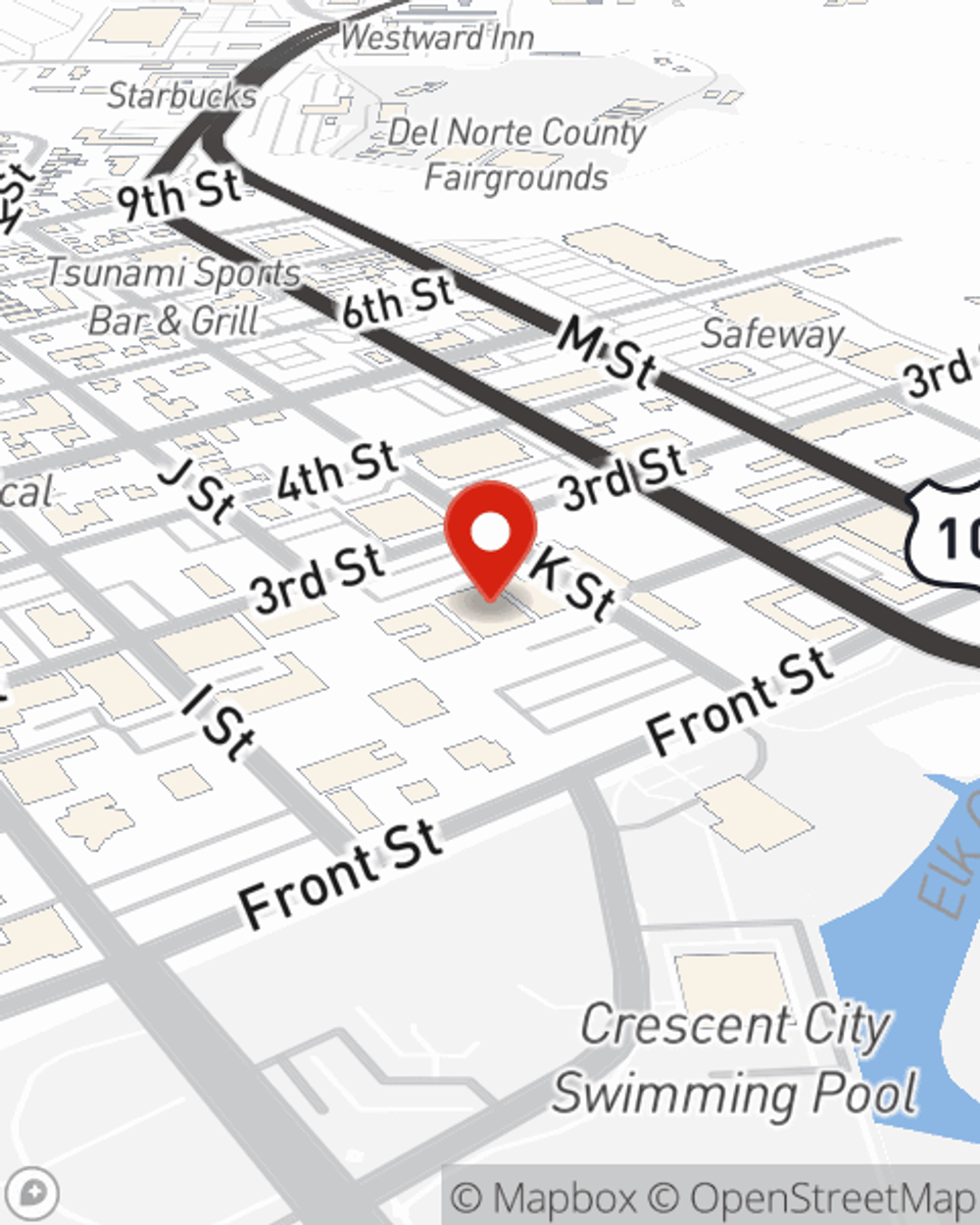

Crescent City, CA, it's time to open the door to reliable protection for your home. State Farm agent Lisa McKeown is here to assist you in creating your plan. Call or email today!

Have More Questions About Homeowners Insurance?

Call Lisa at (707) 465-1799 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

DIY pest management & wildlife control tips

DIY pest management & wildlife control tips

Mole, ground squirrels, and various other pesky critters can be difficult to get rid of. We have tips for rodent removal.

Lisa McKeown

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

DIY pest management & wildlife control tips

DIY pest management & wildlife control tips

Mole, ground squirrels, and various other pesky critters can be difficult to get rid of. We have tips for rodent removal.