Business Insurance in and around Crescent City

Crescent City! Look no further for small business insurance.

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with extra liability coverage, a surety or fidelity bond and worker's compensation for your employees.

Crescent City! Look no further for small business insurance.

Helping insure small businesses since 1935

Surprisingly Great Insurance

When you've put so much personal interest in a small business like yours, whether it's a pet groomer, a floor covering installer, or a lawn sprinkler company, having the right coverage for you is important. As a business owner, as well, State Farm agent Lisa McKeown understands and is happy to offer customizable insurance options to fit your business.

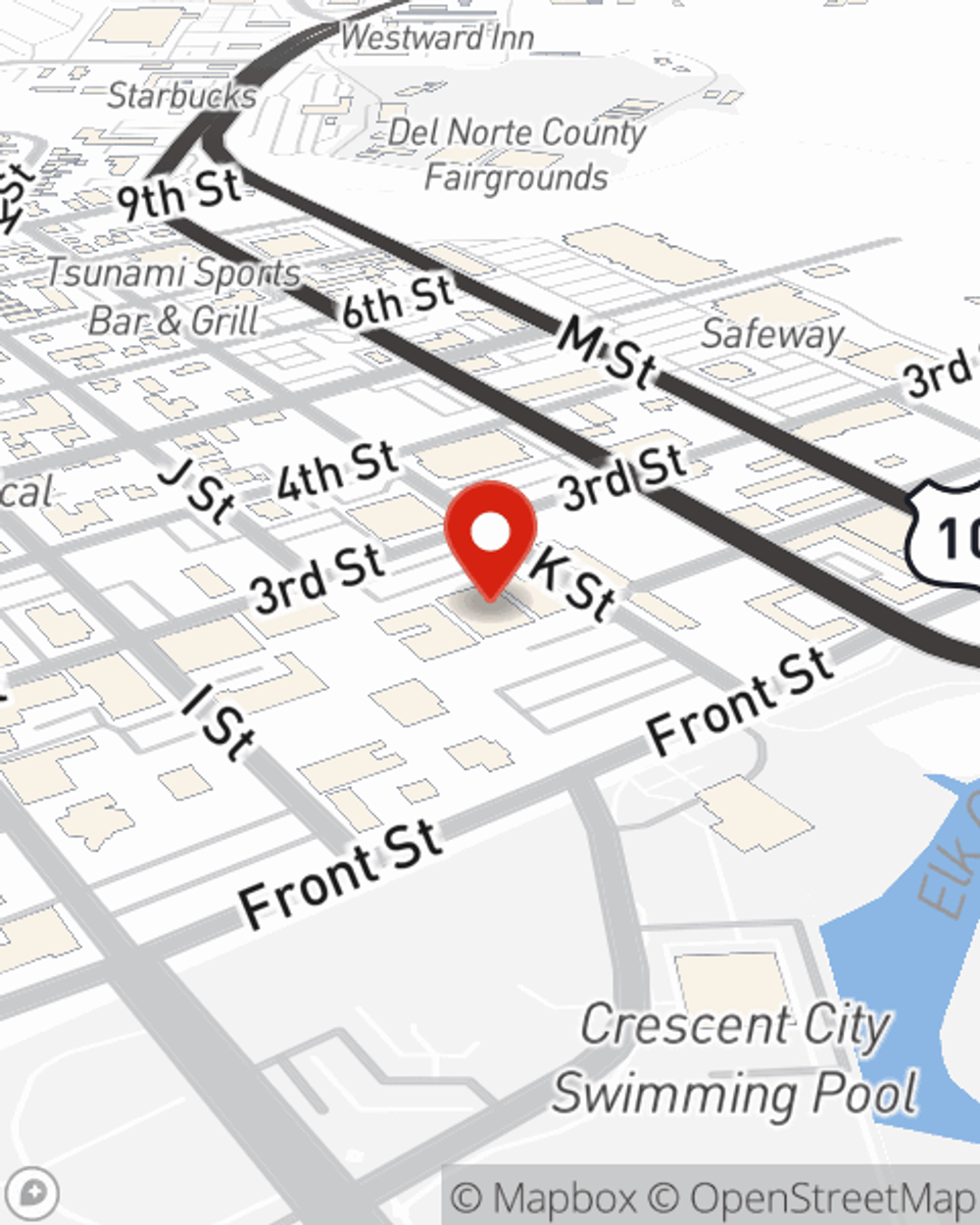

Ready to consider the business insurance options that may be right for you? Stop by agent Lisa McKeown's office to get started!

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Lisa McKeown

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".